Much public attention has been focused on the growing debt burden of higher education students. One New York Times article proclaimed that this is “a generation hobbled by the soaring cost of college,” citing more than $1 trillion in student loans outstanding. The authors focused on one graduate with $120,000 in debt and no good job prospects.

While such cases are dramatic, most graduating students have less debt. At Cornell, thanks to the University’s need-based financial aid policies, a majority of students graduate with no debt or only modest indebtedness. For the 45 percent of the Class of 2012 that had ever borrowed, the mean cumulative student debt at graduation was only $20,490.

There is, however, another debt crisis in higher education—one from which Cornell has not been immune. While most people understand that colleges and universities hold financial assets, it is less well known that they also borrow funds and incur debt. The New York Times has reported that, for the more than 500 academic institutions whose debt was rated by Moody’s, college and university debt doubled in inflation-adjusted terms between 2000 and 2011 and stood at more than $205 billion in 2011. At Cornell, the total external debt level (for Ithaca and the Medical College) was $495 million on June 30, 2003; ten years later, on June 30, 2013, it had risen to almost $1.9 billion—a 375 percent increase.

In an exception to long-standing policy, construction on the Physical Sciences Building on East Avenue was undertaken with no major gifts to support it.

Why do universities borrow money?

Academic institutions borrow for many reasons. They may finance building projects— partially or entirely—that have revenue streams associated with them that will cover the cost of debt service; for example, residence life projects such as student housing and dining facilities, where debt-service costs can be included in the housing and dining rates. They also may borrow to finance infrastructure projects such as IT networks or for utilities (heating, electric power, cooling), where debt-service costs can be charged out to users and recouped through tuition and other revenues that the units receive.

More than $400 million in gifts has helped fund the Medical College’s $650 million Belfer Research Building. Photo: John Abbott

Many construction projects, especially academic and research buildings, are financed largely by gifts from individuals, corporations, foundations, and the government. Academic institutions—and Cornell is no exception—have used a process in which the Development office makes a feasibility assessment of the number and size of gifts that are likely to be received for a project; typically the project is undertaken only if the projections exceed the expected cost. However, debt financing may be used “strategically” if otherwise the institution would fund part of the project with its endowment and the expected return on the endowment exceeds the cost of borrowing funds. It may also be used for buildings in which externally funded research is conducted, because the interest payments on such debt can be at least partially recovered from the research grants.

Even if the projections are accurate, sometimes gifts are received at a slower rate than anticipated and the institution must borrow “bridge funds” to finance a project until the anticipated gifts have all been received. In some cases, the project costs more than expected or the gifts fall short. When this occurs, institutions must borrow using long-term debt. The funds needed to service the debt will come from the general operating budget, which includes revenues from tuition, gifts, endowment spending, and cost recoveries on external research grants. For universities with a medical college, revenues from physician practice plans may also be included.

Academic institutions also use lines of credit—short-term borrowing—to help cover operating expenses, as the revenue that a university receives does not necessarily generate a smooth flow of funds over the course of a year. For example, tuition payments flow primarily at two points of time (the start of the fall and spring semesters), but staff salaries and other expenditures occur all year. Similarly, funding from the federal or state governments may not arrive until after expenditures have been made.

If an institution has sufficient financial assets invested in very liquid form (short-term money market instruments), this reduces the need for lines of credit; however, if the rates of return on longer-term assets such as stocks, bonds, and private equity are substantially higher than money market rates, asset managers may focus their investments on these and seek to preserve liquidity through lines of credit. Prior to the financial collapse of 2008, many institutions, including Cornell, did not worry a lot about the liquidity in their asset portfolios and depended on lines of credit to assure that they had the funds to make payments. During the crisis, when it was feared that lines of credit might be frozen, many institutions borrowed large sums to generate liquidity and avoid having to sell endowment assets in a depressed market. In 2009, Cornell borrowed $500 million, split equally between five- and ten-year maturity bonds.

How do universities borrow?

Nonprofit institutions can borrow using tax-exempt debt—which allows them to pay lower interest rates—for qualified capital projects such as new buildings, renovations, and infrastructure that are used for educational purposes. These projects cannot be used for any taxable activities or for business incubators. Borrowing to support operating expenses, either long-term or via lines of credit, must be done at taxable rates.

Long-term borrowing can be done at either fixed or variable interest rates. Variable- rate bonds have weekly or daily maturities and interest rates that are tied to a broad index rate; their interest rates may increase or decrease over the life of the bond. Decisions on whether to issue fixed- or variable-rate securities are based on the institution’s expectations as to what will happen to interest rates over time.

To provide protection when an institution is unsure about the direction in which interest rates will move, it can buy “swaps”—contracts that require it to sell bonds in the future with a variable or specified interest rate. For example, if an institution is planning a construction project that will start in three years and it believes that interest rates will rise, it can buy a swap that allows it to lock in a lower future interest rate for the bonds needed to finance the project. This has a risk: if interest rates fall, the value of the swap becomes negative because it will force the institution to borrow at a higher rate than the then-prevailing market rate.

In some circumstances, a university can try to “unwind” a swap by paying market price at the time to get out of the contract.Unwinding swaps can be costly— and in some cases it is not possible to exit the contract, so the institution is locked into borrowing at a higher rate than necessary. Last July, Bloomberg News reported that Cornell purchased more than $1 billion of swaps before the financial collapse, that it had paid $30 million in termination fees in 2010 to unwind some of these swaps, and that it is continuing to pay interest on bonds that it has never issued because of the swap contracts that it could not unwind. Cornell has never confirmed the report’s accuracy.

What determines interest rates?

Given the prevailing interest rates at a point in time, the actual interest rate that a university must pay on a bond it issues depends upon its credit ratings. The major raters—Moody’s and Standard & Poor’s are two of the largest—determine an institution’s rating based upon many financial and academic indicators that measure student demand, financial reserves, capital investment and debt, operating performance (including diversity of revenue sources), and the quality of management and governance.

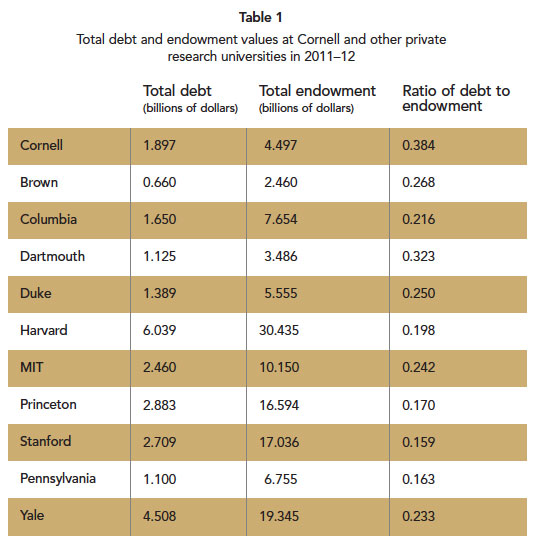

Debt data is at the end of FY2012 and was shared with us by the Yuba Group from FY12 financial statements and rating reports. Endowment data is from Cornell’s 2013-14 Operating and Capital Budget Plan (May 2013), Table L. All data have been rounded to the nearest million dollars. These data do not take into account the support Cornell received for operations and capital projects from New York State for its contract colleges.

Moody’s highest ranking, Aaa, is given to institutions that demonstrate the strongest creditworthiness relative to other tax-exempt issuers. The rankings then decline to Aa, A, Baa, Ba, B, Caa, Ca, and C, with rankings below Baa indicating below-average creditworthiness. Within each category other than Aaa, Moody’s adds a numerical modifier indicating that the institution is in the highest (1), midrange (2), or lowest (3) part of that category. As an institution’s ranking declines, the interest rate it must pay increases; this limits its ability to borrow funds and undertake projects. With interest rates at current historically low levels, the spread on rates between the top classes is very low: if Cornell’s rating changed in either direction, the impact on its borrowing rate would probably be in the range of 10 to 15 basis points (0.10 to 0.15 percentage points).

In May 2007, prior to the financial collapse, five Ivy League schools (Columbia, Dartmouth, Harvard, Princeton, and Yale) were rated Aaa; Brown and Cornell were rated Aa1, and Penn was rated Aa2. In April 2010, Moody’s warned of a possible downgrade of Cornell’s rating by revising its outlook to negative. In response to the steps that the University was undertaking to restore its financial equilibrium, this downgrade never occurred. In February 2012, Moody’s returned Cornell’s outlook to stable. (Standard & Poor’s did reduce Cornell’s rating after the financial collapse, downgrading it from AA+ to AA, which is the equivalent of a move from Aa1 to Aa2 on the Moody’s scale.) In July 2012, after most institutions had recovered from the worst of the financial crisis, the only Ivy school whose Moody’s rating was lower than in 2007 was Dartmouth, which had dropped to Aa1. However, among the broader set of colleges and universities rated by Moody’s, more than twice as many schools saw their credit rating downgraded rather than upgraded during this period.

Why did Cornell’s debt increase so dramatically?

Cornell is not unique in having a high level of debt. See Table 1, which shows the total debt and endowment value, as of 2011–12, for Cornell and ten other private research universities. Cornell’s debt of $1.897 billion ranked sixth, although its ratio of debt to endowment, .384, was the highest of the group. (It is important to note that the debt on construction projects at the contract colleges that is financed by New York State bonds is not included in Cornell’s debt total. The state funds the interest payments on that debt.) While some might conclude from this ratio that Cornell has taken on too much debt, the story is actually much more complicated.

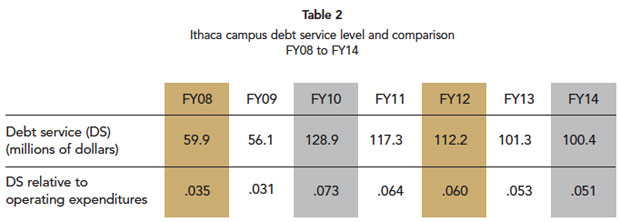

Source: Authors’ computations rom data presented in the 2009-10 to 2013-14 issues of Cornell’s Operating and Capital Budget Plan (Ithaca Campus – Summary Table). The figures for FY09 to FY12 are actual realized values; those for FY13 are forecasted final values, and those for FY14 are the budget plan values.

Cornell’s debt balance for capital projects in June 2013 was approximately $948 million on the Ithaca campus and $449 million at Weill Cornell Medical College. More than half of this debt came from three sets of major construction projects, whose different natures illustrate the complexities of institutional debt.

Debt from two major projects relating to infrastructure contributed to about 14 percent of the Ithaca total. The Lake Source Cooling project of the late Nineties expanded the capacity of the University to cool buildings in a way that was environmentally friendly and at a lower operating cost than conventional alternatives. Similarly, the Combined Heat and Power Plant, which became operational in December 2009, was expected to lead to dramatically improved efficiency and thus lower operating costs, as well as lower greenhouse gas emissions. Although not part of the initial plan, it also allowed the University to eliminate its use of coal, which further reduced greenhouse gas emissions.

These two projects were planned to be funded with debt, and their debt service is charged out to units in the rates they pay for utilities. Although the debt for both projects is still being paid off, if the projected savings for the latter prove correct, both will have reduced the utility rates charged to units below what they otherwise would have been, and thus both will have been economically beneficial as well as environmentally friendly.

Decisions made by Cornell’s leaders to provide a common living experience for first-year students led to the expansion of residence life on North Campus in the late Nineties. A decision was also made to guarantee all sophomores the opportunity to live on campus, which led to building the living-and-learning houses on West Campus. Again, both projects were planned to be funded by debt; their debt service, which currently is about 18 percent of the Ithaca campus total, is charged to students living on campus in the rates they pay for housing and dining. So the Cornell students who benefitted from these improved facilities directly bore their cost. And, to the extent that higher residence- life costs increased the grant aid that undergraduate recipients received, these financial aid costs took funds away from the academic side of the University and put pressure on tuition levels.

A major research university always wants to have the most modern and upto- date scientific facilities to foster innovative research and to attract and retain high-quality faculty. After the completion of Duffield Hall, which placed Cornell at the forefront of research in nanotechnology, the University understood that to be a twenty-first-century leader in genomics and other emerging life sciences a new facility would be needed on the Ithaca campus. And, in 2006, a decision was made to build another new facility to enhance Cornell’s research capabilities and ability to attract grant funding in the physical sciences.

For both of these projects, it was anticipated—after prospect analysis by the Development office—that at best they could be only partially financed through donations from public and private sources. Nonetheless, initial budget projections for the two projects prepared by the provost’s office and published in Cornell’s budget-plan documents assumed that both would be fully funded by gifts.

Given the pressure the University felt to remain at the forefront of scientific research, both projects began before substantial external funding was received. In addition, the estimated costs of both projects increased. While a $50 million gift was received from Joan and Sandy Weill ’55 to support construction costs for the life sciences facility and an institute to be housed there—in recognition of which the University named the building after them—the flow of gifts that was anticipated to fund Weill Hall never fully materialized. Over time, the annual budget and operating plan began to assume that a bridge loan would be needed to complete the construction. Then, shortly after the building opened in 2008, financial markets collapsed and prospects for large gifts to complete the funding vanished. The bridge loan became much more long term.

Construction of the Physical Sciences Building began in November 2007, although no major gifts had been received for the project. The University’s 2008–09 budget plan assumed that only a small portion of the cost would be funded by long-term debt, with the vast majority of the construction costs funded via a bridge loan. After Cornell’s large projected structural deficit became apparent in 2009–10, the debt for this project clearly became more long term. Debt from Weill Hall and the Physical Sciences Building now represents more than 20 percent of the Ithaca campus’s capital-project debt balance.

President David Skorton instituted a temporary freeze on all new construction in 2009–10; that was followed a year later by a stricter set of spending guidelines requiring that no more than 50 percent of any capital project should be debt financed, unless it was a life safety or major infrastructure priority. New noncore facilities, such as the Johnson Museum expansion, were to be constructed without any debt. In addition, debt financing for any project should be undertaken only if the overall financial position of the University, as measured by key financial ratios, permitted it.

A major project now under way at Weill Cornell Medical College in New York City is the $650 million Belfer Research Building. More than $400 million in gifts has been received to support that project, which is being partially financed by debt in the range of $218 million. This building was deemed by the University’s leaders to be essential to the future of the Medical College. However, the debt it added to the balance sheet brought Cornell to the point where a decision was made that, at least temporarily, no new debt will be permitted for any building projects, including those at the Cornell Tech campus. For the time being, construction at Cornell will be, in President Skorton’s words, “in a pay-as-yougo mode.”

These three buildings all make important contributions to the research mission of the University. Some, but not all, of the support for their debt service comes from cost recoveries on federally funded research conducted within the buildings. But because their debt service comes largely from the operating budget of the University, its impact on that budget must be considered. Table 2 shows, for the Ithaca campus, how debt service in the operating budget has varied between FY08 and FY14. The dramatic doubling in debt service in FY10 is largely due to another cause: the $500 million in taxable bonds that Cornell issued in 2009 after the financial meltdown to generate liquidity and avoid having to sell off endowment assets at depressed prices. The gradual decline in debt-service levels in the years after FY10 reflects the fact that Cornell has not been taking on any new debt for construction and some of its existing debt is being retired.

What are Cornell’s prospects?

Debt service was about 3 percent of Cornell’s operating expenditures in FY09, before the financial crisis. By FY10 it had jumped to 7.3 percent; this reflects both the increased cost of debt service in that year and the reductions in operating expenditures that the University was making to solve its structural budget problem. This included freezes on faculty and staff salaries for a year as well as reductions in employment. Since then, the ratio has fallen back to slightly more than 5 percent. This ratio will continue to decline in future years as more debt is retired. A big reduction will occur in FY14, when Cornell will retire the first half of its $500 million taxable debt; a second big reduction will occur in FY19 when the remaining $250 million will be retired.

Ronald Ehrenberg (left), director of the Cornell Higher Education Research Institute, with co-author Ross Milton, a PhD candidate in policy analysis and management. Photo: Lindsay France/UP

The annual debt-service payment on the $500 million of taxable debt was $24.5 million last year. After the first half of the debt is retired, the payment will fall to $13.6 million and about $10.9 million will be freed up from the FY14 budget. Cornell could use these funds for such things as new initiatives, faculty and staff salaries, undergraduate financial aid, or limiting tuition increases. Then, in FY19, the end of the remaining payments will provide another set of choices.

As Cornell’s external debt declines, its financial picture will improve. The University will have more freedom to borrow funds without fear that doing so would reduce its bond rating, which would increase the cost of borrowing and make servicing the cost of future debt more difficult. Will Cornell ever return to using debt financing for new building projects? We shall see.

As our analysis shows, Cornell has incurred debt to support many worthwhile and important projects. Borrowing is a key aspect of the University’s operation, but it is not without risk. Just as an individual who borrows to buy a house takes on the risk of not being able to pay off the mortgage, the University must always consider how and when it will be able to repay its loans—and whether such borrowing will have an adverse effect on its overall financial picture. We’ve also seen that drawing simplistic conclusions about an institution’s debt level can be deceptive. With projects such as Lake Source Cooling and the Combined Heat and Power Plant, Cornell’s borrowing led to efficiencies that reduced costs. Careful analysis of the reasons for borrowing and the impact of debt are required—and that’s why this is such an important issue for the University’s administrators and trustees.

Ronald Ehrenberg is the Ives Professor of Industrial and Labor Relations and Economics and director of the Cornell Higher Education Research Institute (CHERI). Ross Milton is a PhD student in economics and a graduate research assistant at CHERI.

This article is based upon a working paper posted at the CHERI website (www.ilr.cornell.edu/cheri); that paper includes citations to data sources.